Better Insurance Claims Management with AI-powered Data Analytics by AWS

The insurance industry, like many others, is undergoing a significant technological transformation.

This evolution is most notable in the realm of claims management, where advancements in data analytics, automation, and digital platforms are reshaping traditional practices.

These changes are enhancing efficiency, improving the customer experience, and ensuring compliance with regulatory standards.

In 2023, several key trends shaped the landscape of claims management within the insurance industry. These include,

Automation with Personalized Service:

Insurance companies are leveraging data analytics to balance the automation of claims processing and payments while providing personalized customer service. Effective data management and easy access to relevant data are crucial for making informed decisions.

Adoption of New Technology

Economic market shifts are driving Property and Casualty (P&C) insurers to rapidly adopt new technologies. This adoption is essential for improving efficiency and reducing costs. Agility in adapting to new technologies and workflows is becoming increasingly vital.

Collaborations with Insurtech

Partnerships between established insurance companies and insurtech startups are on the rise. These collaborations aim to develop innovative claims solutions tailored to address specific industry challenges or operational changes.

Growth of Digital Distribution Channels

The insurance industry is seeing a surge in digital distribution channels, such as online marketplaces and aggregators. The continuation of embedded insurance products, which offer low-effort customer experiences, is a notable trend.

Compliance and Regulation

Navigating the changing regulatory environment remains a challenge for insurers. Utilizing technology to efficiently meet compliance and regulatory requirements is increasingly important for carriers.

These trends reflect an industry in transformation, where technology, customer expectations, and regulatory compliance converge to shape the future of claims management. Insurance companies are leveraging technology to enhance efficiency, ensure compliance, and improve customer experiences while adapting to economic and market shifts.

Data Analytics and Claims Management

Data analytics has become a vital component in insurance claims management, offering benefits that significantly enhance efficiency and decision-making.

A Deloitte study found that 56% of North American insurance industry leaders are exploring increased investment in data analytics.

This shift is driven by the need for a more proactive, data-first approach, enabling quicker problem-solving and more efficient claims processing.

Predictive analytics, a key aspect, helps solve problems before they occur and guides claims down the correct path from the start, significantly improving workflow efficiency and overall claim outcomes.

Integrating AWS Glue in the Data Analytics Process

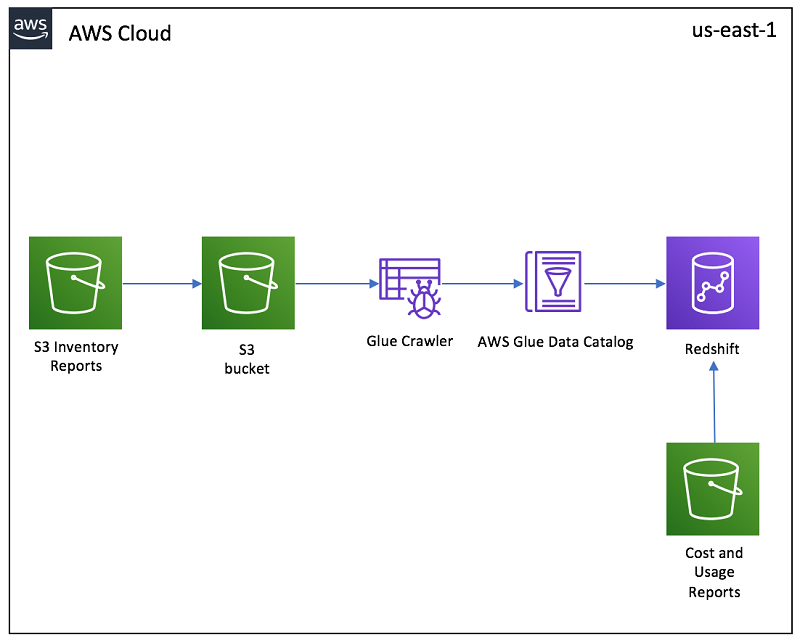

An integral part of this technological advancement in claims management is the role of AWS Glue. This service streamlines the extraction and transformation of raw data from various data silos into a unified format.

Data silos, often a challenge in large organizations, lead to isolated and underutilized data repositories. AWS Glue effectively addresses this by consolidating disparate data sources, making the data readily available for analysis.

The integration of AWS Bedrock and Amazon QuickSight takes claims management to a new level. Bedrock’s robust data aggregation capabilities provide a unified view of claims data, essential for comprehensive analysis.

It seamlessly integrates data from diverse sources such as policy databases, claim submission portals, and third-party information like healthcare records or repair estimates. The versatility of Bedrock lies in its compatibility with various data formats and sources, ensuring a comprehensive aggregation of claim-related information.

Once the data is aggregated, Amazon QuickSight’s dashboard feature comes into play. QuickSight’s dashboards provide a holistic view of aggregated claims data, allowing claims managers to identify patterns and trends across different types of claims.

For instance, QuickSight’s ML-powered anomaly detection can highlight unusual claim patterns, such as a sudden increase in claims from a specific region or atypical patterns in certain types of claims. This capability is vital for strategic decision-making and improving the efficiency of claims processing.

Enhancing Data Management with Amazon S3 and RedShift

Incorporating AWS Glue into this framework enables the extraction of raw data from various data silos into Amazon S3 or RedShift. Amazon S3 offers scalable storage services, making it an ideal repository for large volumes of data. On the other hand, Amazon RedShift serves as a powerful data warehouse, providing fast analytics on petabyte-scale data. This comprehensive approach to data storage and management ensures that all relevant data is centrally located and accessible for in-depth analytics.

Bedrock applications then pull this organized data from Amazon S3 or RedShift for detailed analytics. This step is crucial in transforming raw data into actionable insights that drive strategic decisions in claims management.

AWS at Every Stage of Claim Management

The application of AWS technologies spans the entire spectrum of the claims management process:

- First Notice of Loss (FNOL): Bedrock automates data collection from multiple sources, while QuickSight offers real-time dashboards for tracking claims.

- Claim Assessment and Investigation: QuickSight analyzes data to identify patterns, flagging anomalies for further investigation.

- Adjustment: Historical data analysis by QuickSight informs settlement amounts.

- Approval and Disbursement: QuickSight enhances decision-making speed for faster claim approvals, and Bedrock organizes and makes all documentation accessible.

- Subrogation: Potential cases for subrogation are identified through data analysis via QuickSight.

- Closure: Both QuickSight and Bedrock ensure comprehensive analysis and documentation, confirming the resolution of claims.

Conclusion

The integration of AWS services like Glue, QuickSight, Bedrock, Amazon S3, and RedShift represents a paradigm shift in insurance claims management. This tech-driven approach not only streamlines the claims process but also ensures more accurate, efficient, and customer-centric outcomes.

By harnessing the power of advanced data analytics, insurance companies are poised to navigate the challenges of the modern market more effectively, meeting evolving customer needs and regulatory requirements with greater agility and precision.