For Faster, Smarter Insurance Insights

Streamline processes, enhance customer experience & accelerate business outcomes with AI & industry expertize

Intelligent, AI-driven Decision Across Key Insurance Functions

Omni-channel Marketing

- Market Assessment

- Agent Enablement

- Content Generation

- Sustainable Marketing

AI-powered Underwriting

- Risk Assessment

- Data Driven Decisioning

- Policy Generation

AI Servicing Assistant

- Hyper-personalization

- Proactive Notifications

- Complaints Handling

- Sustainable Operations

Zero Touch Claims Processing

- Automated Processing

- Adjudication insights

- Subrogation/Litigation

- Omnichannel Servicing

Omni-channel Marketing

- Market Assessment

- Agent Enablement

- Content Generation

- Sustainable Marketing

AI-powered Underwriting

- Risk Assessment

- Data Driven Decisioning

- Policy Generation

AI Servicing Assistant

- Hyper-personalization

- Proactive Notifications

- Complaints Handling

- Sustainable Operations

Zero Touch Claims Processing

- Automated Processing

- Adjudication insights

- Subrogation/Litigation

- Omnichannel Servicing

Automate & Expedite your Insurance Operations with TeqNext AI

Automate Tedious Tasks, Drive Faster Decisions, Deliver Exceptional Customer Experiences, and Boost Profitability

Target the Right Audience, Craft Personalized Marketing Campaigns

Data-driven engagement powered by GenAI for omni-channel marketing

Product Campaign

Territory Selection

Client Profiling & Segmentation

Content Generation

Channel Selection

Launch Campaign

Make Informed Decisions, Reduce Underwriting Risk, Increase Efficiency

Data-driven decision management using AI-powered Underwriting

Submission

Extraction

Enrichment

Assessment

UW Portal

Deliver Exceptional Servicing, Enhance Agent Productivity

Data-driven decision management using AI-powered Underwriting

Preparing for the Day

Review Schedule

Responding to Queries

Processing Claims

Policy Renewal Changes

Research follow-up assigned cases

Documentation & Record Keeping

Training & Development

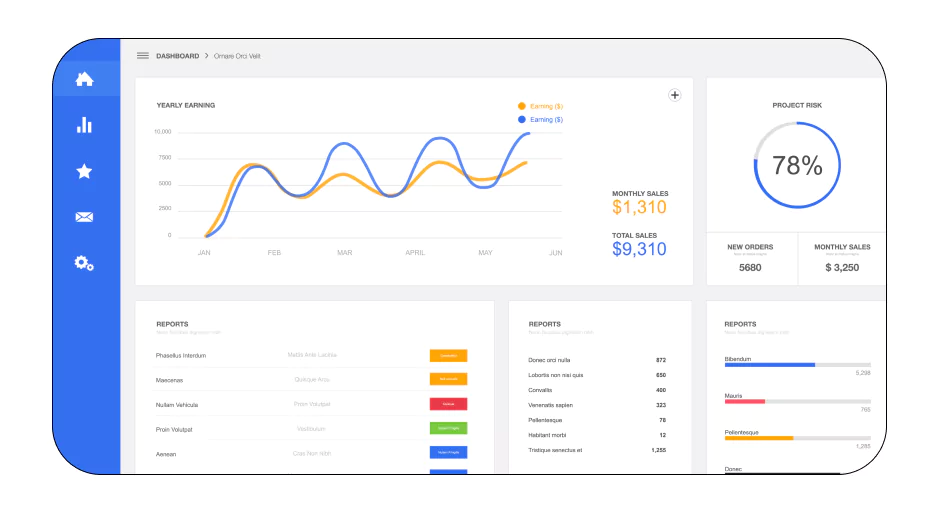

Performance Dashboard

Automate Manual Tasks and Improve Resource Productivity

Zero touch automated claims processing

Pre-Claim

TeqNext AI streamlines the initial claim intake process by offering self-service options and automating data collection through various channels.

Digital FNOL & Eligibility

TeqNext AI expedites claim processing by intelligently extracting key data from FNOL submissions and verifying policy eligibility in real-time.

Claim Setup

TeqNext AI minimizes errors by automating data entry and validation tasks, ensuring accurate claim setup from the start.

Adjudication & Settlement

TeqNext AI streamlines claims processing by automating tasks like inspections, estimate collection, and customer updates. It speeds up settlements, enhancing customer satisfaction for insurers.

Support

TeqNext AI analyzes vast amounts of data to facilitate faster and more accurate claims decisions. Also identify potentially fraudulent claims and flagging them for further investigation.

Why TeqNext AI ?

TeqNext AI is a unified tech stack that combines top-notch technological infrastructure. Say goodbye to multi-tool/software purchases; with TeqNext AI, you get a unified source of truth for all your business needs

Enhanced Accuracy

TeqNext AI deliver high level of accuracy in insurance decisions

AI Expertize

Our team comprises certified professionals with extensive expertise in AI/ML technologies

Easy Migration & Adoption

We have best-in-class migration process that is as simple as it gets

Security & Reliability

We meet or surpass global insurance industry security and data privacy standards

Learn how your business can benefit from TeqNext AI for optimizing critical insurance decisions

Industries We Serve

Trusted by Leading Enterprises

FAQs

1. What is TeqNext AI Insurance?

2. How does TeqNext AI benefit my insurance business?

3. How secure is TeqNext AI?

4. Can TeqNext AI integrate with my existing systems?

5. How do I get started with TeqNext AI Insurance?

Resources Hub

Teqfocus Insights & Resources

Access expert insights and valuable resources, crafted to help you gain a deeper understanding of the latest in tech innovation.